Residential sales in the top eight cities have returned to levels seen prior to the COVID. While the real estate industry anticipates a strong rebound in housing demand in 2022, it also expects the Union Budget 2022 to be supportive and enabling. A few important tax breaks to promote the real estate sector, as well as GST waivers or reductions on raw materials, are among the industry’s main hopes from Budget 2022.

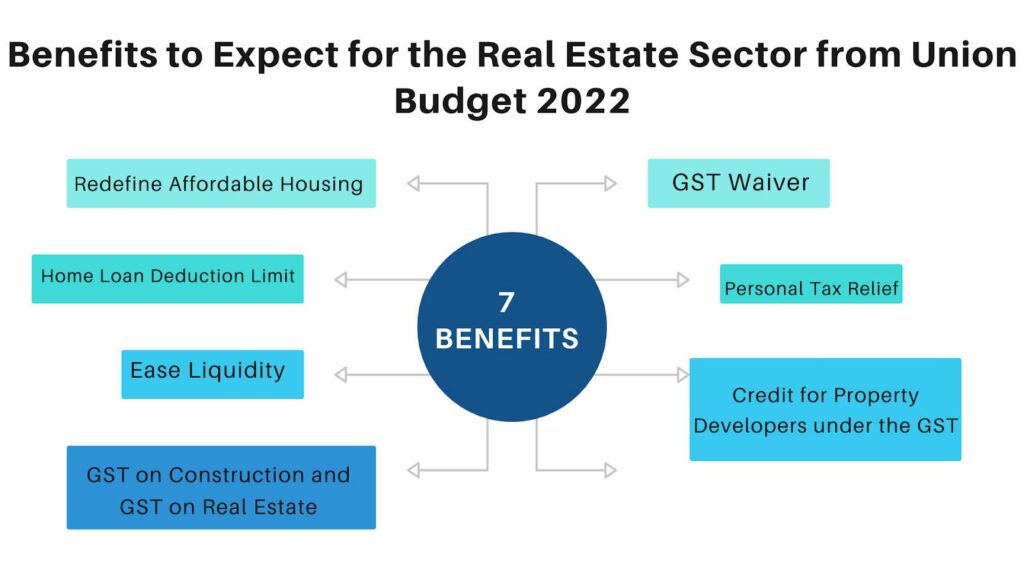

Benefits to Expect for the Real Estate Sector from Union Budget 2022

1. Redefine Affordable Housing:

Affordable housing is determined by the size of the home, its price, and the buyer’s income, according to the Ministry of Housing and Urban Poverty Alleviation In non-metropolitan cities and towns, a unit with a carpet area of up to 90 sq. m., and 60 sq. m. in metropolitan cities and towns. and a value of up to Rs 45 lakh for both, is considered affordable housing. The central bank’s definition, on the other hand, is based on bank loans to consumers for home construction or apartment purchases.

The government should carefully consider adjusting city-by-city price parameters to accommodate a broader consumer base in the benefits that are being given to this segment. While the size of units as defined (60 sq. m. carpet space) is reasonable, the prices (up to Rs 45 lakh) are prohibitively expensive in most locations. For example, a budget of Rs 45 lakh is way too low for a city like Mumbai; it should be at least Rs 85 lakh.

The funding range for other major cities should be expanded to at least Rs 60-65 lakh. More homes will fall under the affordable price range as a result of this price reduction, allowing more purchasers to take advantage of various perks such as lower GST rates of 1% without ITC, government subsidies, and a tax deduction of Rs 3.5 lakh on home loan interest repayment.

2. Home Loan Deduction Limit (u/s 24):

The Rs 2 lakh tax rebate on home loan interest rates under Section 24 of the Income Tax Act should be increased to at least Rs 5 lakh. This could lead to a boost in home demand, especially in the lower and middle price ranges.

3. GST Waiver:

A GST exemption for the under-construction property would be the cherry on top. The government, on the other hand, decreased the GST rates for under-construction property from 12 percent to 5 percent, and for affordable housing from 8 percent to 1 percent.

4. Personal Tax Relief:

Personal tax relief, either in the form of lower tax rates or revised tax slabs; the deduction ceiling under Section 80C was last increased in 2014 (to Rs 1.5 lakh per year), and an upward revision is long needed.

5. Ease Liquidity:

The liquidity crisis has had a cascading effect throughout industries, including real estate. In the previous two years, buyer confidence has been seriously harmed by project delays, which are the most serious consequence of the financial shortage. Developers want a steady stream of funds to keep the supply pipeline full, particularly for ready-to-move-in homes, which are in great demand. Increased supply also aids in the stability of property values.

6. Credit for Property Developers under the GST:

They also expect a GST credit for developers, as well as a drop in stamp duty, which has already occurred in numerous states, and registration fees, which add a significant amount to the cost of a project, improving house buyers’ confidence and encouraging them to purchase a property.

7. GST on Construction and GST on Real Estate:

- Extension of the tax holiday: Developers want the tax holiday to be extended beyond March 2022 in order to boost demand and the real estate sector’s revival.

- Extension of the Credit Linked Subsidy Program (CLSS): Realtors are requesting an extension of the CLSS Scheme for Middle Income Groups (MIG) under the Pradhan Mantri Awas Yojana (PMAY) until December 31, 2022. The idea is that the timeframe will make use of the monies allotted.

- Giving infrastructure status: For a long time, realtors have demanded that the industry be given infrastructure status. It will undoubtedly aid in the development of industry liquidity and the determination of supply-side costs.

- Coworking spaces: TDS deductions should be reduced for coworking space owners. They want them to be placed in a 2% slab. They are currently in a 10% tax bracket. They do this because they feel receivables are related to services.

- Single window clearance: Many government entities have an impact on the delivery timeline when a project is approved. The project developers expect a single mechanism or single window clearance to aid with such an issue. Although the RERA Act was passed in 2016, some builders are still losing money because they are unable to complete projects on time.

Given the critical role that real estate development can play in job creation and economic recovery, real estate developers believe that their recommendations will be addressed in this budget.

Read: REAL ESTATE INDUSTRY TO BECOME THE ECONOMIC PILLER FOR INDIA IN 2022