Owning a home is a dream that everyone carries within them. Most of them leave behind this desire only because they feel they do not have enough financial support to buy one of their own. Saving all the money to buy a home may not always be possible.

So what are the alternatives you can think about? When planning to buy a home or initiate any home related requirements, considering availing a home loan. India has a financial system that supports every citizen to chase their dreams. Buying a home being one of the most common dreams of each individual, Indian financial system offers different types of home loan facilities that you can avail.

Read: HOW TO GET HOME LOAN EVEN WITH A BAD CREDIT SCORE?

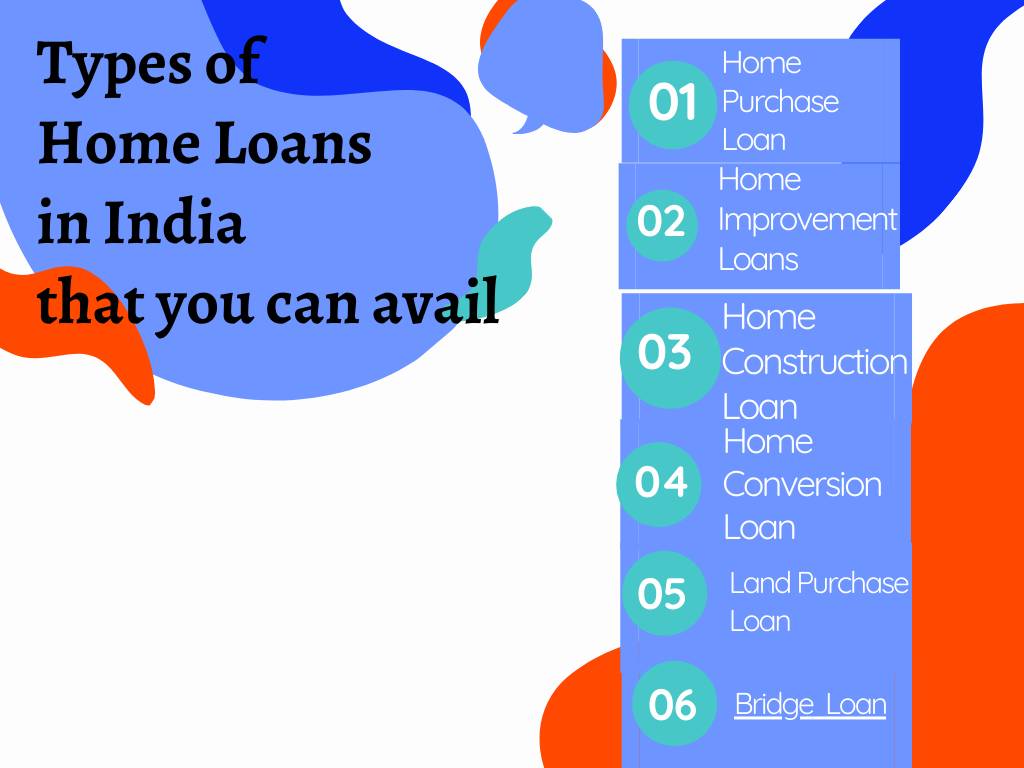

Types of Home Loans in India

Be it buying a new home, modifying or renovating your home, banks offer different schemes and customised plans. Let us take a look at different types of home loans.

- Home Purchase Loan

This is the most opted type of home loan while planning to purchase a home. Home Purchase Loan is used to buy a residential property. Most of the banks in India offer Home Purchase Loan facility where you will get upto 85% of the total cost of the property as a loan. The interest rate for this loan can be either fixed or floating. Before applying for a home loan, you must study in detail about the schemes, interest rate,s etc of the bank. Knowing about the procedures and criterias makes the entire process hassle free.

Also read: LOWEST HOME LOAN RATES – 2021 BEGINNING – PERFECT YEAR TO BUY A HOUSE

2. Home Improvement Loans

If you are planning to modify your home and are in search of the perfect loan option for the same, this is the one. Home Improvement Loans are allowed to extend, repair or renovate your house. One can avail home improvement loans for modification activities like painting, remodelling, internal and external repairs, or even bigger construction work such as adding a floor.

There are some eligibility criterias to be taken care of while applying for a Home Improvement Loan. One can apply as an individual or jointly. Also, both salaried or self employed ones can apply for this type of loan.

3. Home Construction Loan

We have already mentioned about the loan that can be used to purchase a new home. Similarly there is a type of loan which can be used to construct a new house. The interest rates and application process is the same as for any other type of home loan. The thing to be noted is that the amount you get by this type of loan will be based on a rough estimate of the total cost of construction.

4. Home Conversion Loan

This type of loan is slightly different from the above mentioned ones. This type of loan can be availed by those who have already taken a home loan and look forward to applying for an additional loan to buy another home.

You may also refer: HOME LOAN TIPS FOR FIRST TIME BUYERS

The residue amount of the previous loan will be transferred to the new loan. However, since this is taken for a secondary home, the interest rate may be higher depending on the schemes offered by the bank.

5. Land Purchase Loan

Purchasing land and constructing a home is not a new thing. A person who wants to own a home with a dream design will always opt constructing one. Such people can apply for a Land Purchase Loan. Most of the banks in India offer this type of loan and the tenure is comparatively lesser than that of a home loan. This ranges from 5% to 15% and thus the EMI is higher than that of home loans.

This article may help you: TIPS FOR GETTING YOUR HOME LOAN APPROVED FASTER AND EASIER

6. Bridge Loan

A person who wishes to sell their old house and buy a new one can apply for a Bridge Loan. This type of loan bridges the economic gap that happens while buying a new home and selling the old one. This is a short term loan and for the same reason has a slightly higher interest rate.

Once you avail the loan, you will get a time period of six to twelve months to find a buyer for your old home. If you couldn’t find a person within the given time, the bank may take further steps like converting the loan into a mortgage loan with a higher interest rate.

TOP MISTAKES TO AVOID WHILE TAKING A HOME LOAN

Whenever you plan to apply for a loan, be sure to learn in detail about the terms and conditions and the eligibility criterias put forward by the banks. Buying a home is the best investment one can make in life. When you have several options for financial aid, go ahead to make your dream of owning a home happen.

OMG Properties – Quick Bank Loan Assistance!

OMG Properties, one of the reputed, real estate builders in Kerala, helps customers to get home loans according to their choice. We will make a connection between the customer and the bank to proceed with the bank loan documentations at a quick pace.

We also help to choose loans from different types of home loans in India and thus make your process easier.

Contact us now to know more!